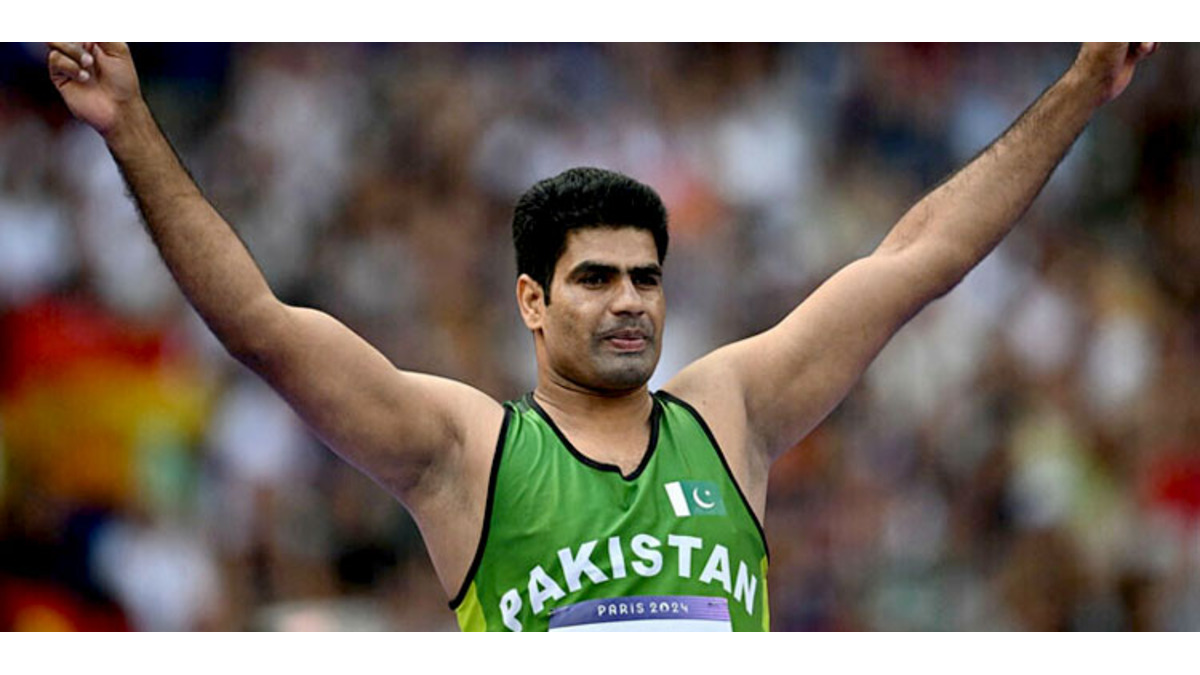

Arshad Nadeem Has to Pay Olympic Prize Money Tax on His First Historic Win

Arshad Nadeem’s remarkable performance at the Olympics has made him a national hero in Pakistan. However, as is the case with most monetary rewards, his winnings are not exempt from taxation. Understanding why Arshad Nadeem must pay the Olympic prize money tax requires an exploration of Pakistan’s tax laws, the nature of his earnings, and the broader legal context.

Olympic Prize Money: What Is It?

Olympic prize money refers to the cash rewards given to athletes by their home countries or sponsors for winning medals or achieving remarkable performances in the Olympic Games. In Pakistan, provincial governments often announce substantial cash prizes to encourage and reward athletes. For instance, Arshad Nadeem received significant financial rewards from various provincial governments and organizations for his outstanding performance.

Taxability of Prize Money in Pakistan

In Pakistan, any income, including prize money, is subject to income tax unless explicitly exempted by law. The taxability of Arshad Nadeem’s prize money stems from the fact that it is considered “income” under the Income Tax Ordinance, 2001. According to this ordinance, income includes any reward, gift, or cash prize earned by an individual, whether it is earned through employment, business, or other means, such as winning an award or competition.

The tax rate applied to such earnings depends on the amount of money received and the recipient’s total income for the year. In Arshad Nadeem’s case, his prize money would likely be classified under “other sources of income,” which is taxable under the same ordinance. The tax law does not differentiate between types of income in terms of taxability unless specific exemptions apply.

The Legal Framework

The legal obligation for athletes like Arshad Nadeem to pay taxes on their prize money is grounded in Pakistan’s broader tax policy. The Federal Board of Revenue (FBR) is responsible for enforcing these tax laws. According to the Income Tax Ordinance, 2001, any income earned by a resident in Pakistan, whether from local or foreign sources, is subject to tax unless a specific exemption is provided by law.

Although some countries offer tax exemptions to their athletes for prize money earned from international competitions, Pakistan does not currently have such provisions. This lack of exemption means that all earnings, including those from the Olympics, are subject to regular income tax.

Why Aren’t There Exemptions?

Several countries have opted to exempt their athletes from taxes on prize money to honor their achievements and encourage future performances. However, Pakistan has not adopted such a policy, possibly due to concerns over tax revenue and maintaining a consistent tax policy across different income sources.

The government may also be wary of setting a precedent that could lead to demands for exemptions from other income types, ultimately complicating the tax code. Additionally, the government’s need for revenue might outweigh the symbolic gesture of exempting such income, especially in a country with relatively low tax compliance and a narrow tax base.

Impact on Athletes

For athletes like Arshad Nadeem, the obligation to pay taxes on their prize money might seem discouraging, especially given the immense effort and dedication required to achieve such success. However, it is important to note that the payment of taxes is a legal obligation that applies to all citizens, regardless of their profession.

Moreover, paying taxes on prize money does not diminish the athlete’s achievement but rather aligns them with the responsibilities of other income earners in the country. It also contributes to the national treasury, which can be used to fund sports development and other public services.

Public Perception and Potential Reforms

There is an ongoing debate about whether the government should introduce tax exemptions for athletes’ prize money, especially for those representing the country on the international stage. Advocates for such exemptions argue that it would serve as an incentive for athletes and a recognition of their contributions to national pride. However, any reform in this area would require careful consideration of the potential impact on tax revenue and the broader implications for tax policy in Pakistan.

Conclusion

Arshad Nadeem’s obligation to pay taxes on his Olympic prize money is a reflection of Pakistan’s existing tax laws, which classify such earnings as taxable income. While this might seem burdensome, it is in line with the legal framework that governs income in the country. Whether future reforms will alter this situation remains to be seen, but for now, athletes must fulfill their tax obligations like any other income earner.

For more detailed information, you can refer to KPMG and a report from Dawn on tax policy in the country (Dawn).

Post Comment

You must be logged in to post a comment.